City Services, Costs, and the Future: FY26 Budget in FocusEach June, the City Council adopts an annual budget for the upcoming fiscal year. The fiscal year 2026 (FY26) runs from July 1, 2025, through June 30, 2026. As with every year, the Mayor, City Council, and city staff spend several months preparing and reviewing the budget to ensure Kaysville continues to provide effective and efficient services that preserve and enhance the quality of life for its residents. Each Council budget meeting is recorded and posted online. Below are links to this year’s recorded budget discussions: - Budget Work Session Kickoff Meeting – February 14, 2025 (Council Work Session)

- Budget Work Session #1 – April 11, 2025 (Council Work Session)

- Budget Work Session #2 – April 25, 2025 (Council Work Session)

- Adopted Tentative FY26 Budget – May 15, 2025 (Council Meeting)

- Budget Work Session #3 – May 20, 2025 (Council Work Session)

- Public Hearing on FY26 Tentative Budget – June 5, 2025 (Council Meeting)

- Adopted FY26 Modified Tentative Budget – June 19, 2025 (Council Meeting |

|

|

|

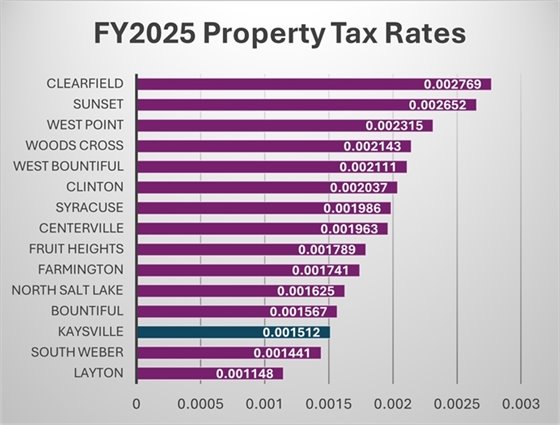

Proposed Property Tax IncreaseUnder Utah law, a “Truth in Taxation” hearing is required whenever a taxing entity, such as Kaysville City, chooses to collect more property tax revenue than it did the previous year. A property tax increase has been proposed for FY26, and the City Council has scheduled a Truth in Taxation hearing for 6:30 p.m. on Thursday, August 7, 2025. Residents should begin receiving hearing notices in the mail this week. The tentative FY26 budget includes a 31.72% increase to Kaysville City’s portion of the property tax, which would result in an additional $14.61 per month for a home valued at $690,000 (the average home value in Kaysville). As shown in the chart below, Kaysville currently has the third lowest property tax rate among the 15 cities in Davis County. The proposed rate would shift Kaysville to seventh lowest, placing it between Centerville and Fruit Heights when compared to current municipal tax rates in the county. |

|

|

|

Figure 1: FY 2025 Municipal Property Tax Comparison |

|

|

|

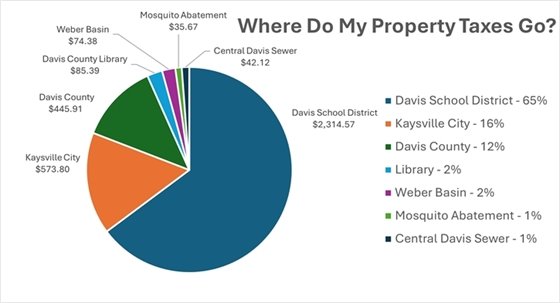

Kaysville has maintained one of the lowest property tax rates in Davis County for many years, despite receiving relatively lower sales tax revenues due to its smaller commercial retail base. As illustrated in the pie chart below, Kaysville City’s portion makes up approximately 16% of a resident’s total property tax bill. For example, a home valued at $690,000 pays approximately $3,571 per year in total property taxes, of which about $573 goes to Kaysville City. This helps fund essential services such as police, fire and EMS, parks and recreation, and more. The proposed FY26 increase would apply only to Kaysville City’s portion of the overall property tax bill. |

|

|

|

Figure 2: Kaysville City Share of Total Property Tax Bill |

|

|

|

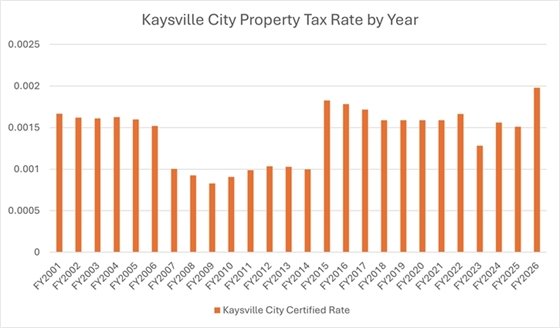

Why Is Kaysville Proposing to Increase Its Property Tax Rate?Despite significant inflation in the cost of providing services over the past few years, the City was able to avoid a property tax increase last fiscal year (FY25) by using budget reserves for certain expenditures and deferring others. These deferred items included sidewalk repairs, vehicle replacements, long-requested and needed staff positions (such as a deputy fire chief), cybersecurity software, preservation of the old library building, and needed improvements to the 35-year-old public works, power, and parks operations center. The City has kept Kaysville’s tax rate among the lowest in the county by operating lean and deferring various costs when possible. As part of this year’s budget process, over $11 million in FY26 budget items were deferred. The proposed FY26 property tax rate increase is the result of years of economic inflation, which has significantly raised the cost of providing basic services. Since COVID, the City has seen significant cost increases across the board, in virtually everything. Material costs, in particular, have surged—water service line replacements are up 458%, new curbs up 227%, sidewalks up 224%, and asphalt up 98%. These rising costs have been compounded by flattening sales tax revenue, one of the City's two primary sources of funding alongside property tax. The proposed increase reflects the true cost of continuing to provide the baseline services residents expect, such as police, fire and EMS, and parks and recreation. The one notable addition to these baseline services in FY26 is the planned expansion of recreational opportunities through a partnership with the Davis School District (DSD) to build Kaysville’s first community fitness center, described in the next section. As shown in the bar chart below, Kaysville’s property tax rate has generally declined or remained steady over the past 25 years, with the exception of a significant 83% increase in 2014. That increase was driven primarily by bonding for the construction of a new police station, as well as additional costs associated with the City’s transition from a volunteer to a full-time fire department. |

|

|

|

Figure 3: Kaysville City Property Tax Rate History |

|

|

|

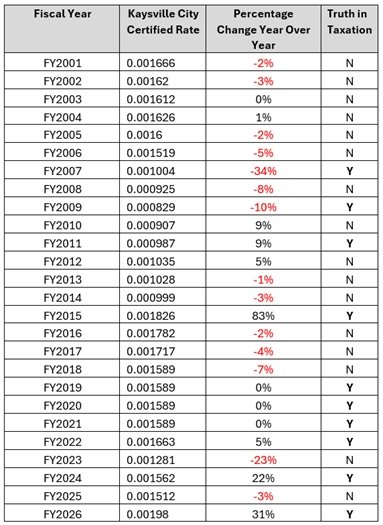

As previously noted, under Utah law, a Truth in Taxation (TNT) hearing is required whenever a taxing entity like Kaysville City chooses to collect more property tax revenue than the previous year. As shown in the table below, Kaysville has held TNT hearings and increased total property tax collections 10 times in the past 25 years. These increases are often necessary to adjust for inflation, even in years when the tax rate itself does not change (e.g., FY2019, FY2020, and FY2021). When home values rise, even a flat tax rate results in more revenue. TNT provides a transparent way for the City to adjust collections to keep up with inflation or fund major projects— such as a new police station, gymnasium, or expanding full-time public safety services. |

|

|

|

Table 1: Kaysville City Property Tax & Truth in Taxation History |

|

|

|

Kaysville Fitness CenterKaysville has a generational opportunity to expand recreational offerings for residents by partnering with the Davis School District (DSD) to build the city’s first community fitness center. The facility is planned as a standalone building adjacent to Kaysville Junior High and will include four full-size basketball courts, a second-level walking and jogging track, a multi-use fitness room, and other flexible spaces that can be programmed for a variety of recreation and community uses for residents of all ages. In exchange for partnering with the school district on the cost, the facility will be branded as a Kaysville City facility (e.g., Kaysville Fitness Center) and will be open for public use outside of school hours—including early mornings, evenings, weekends during the school year, and nearly all days during the summer. By cost-sharing with the school district, the facility can be expanded from the originally planned two courts to four, better meeting the growing demand from both city and school district programs—maximizing the use of taxpayer dollars. While the City currently offers robust recreation programming, it has not been able to fully meet demand due to a lack of indoor space. In addition to popular programs like Junior Jazz basketball, this facility would support expanded offerings such as adult recreation leagues, indoor pickleball, year-round track access for walkers and joggers, yoga classes, fitness equipment, and many other recreational or community programs based on resident interest. This type of partnership between cities and DSD is not new, and it has proven to be a cost-effective model for other communities. Layton City has partnered with DSD on three community gymnasiums, including its most recent facility at Shoreline Junior High (see photos below). West Point City has also partnered with DSD to build a shared gymnasium at Horizon Junior High, opening this fall. Both the Layton Shoreline and West Point Horizon facilities are comparable in size and amenities to the one planned for Kaysville. |

|

|

|

Figure 4: Layton City Shoreline Gymnasium (upper-level track and fitness equipment) |

|

|

|

Figure 5: Layton City Shoreline Gymnasium (lower-level courts) |

|

|

|

While the majority of the cost for the Kaysville facility would be funded by DSD, Kaysville City’s share is expected to be $10.5 million. A facility of this scale would require bonding and would be repaid over several years using a combination of property tax revenue and existing RAMP sales tax revenues. The annual debt service on a 25-year bond is projected to cost the owner of a $690,000 home (the average home value in Kaysville) approximately $31 per year in property tax. The City recognizes that $10.5 million is a substantial investment, but also considers it a meaningful commitment to the physical, mental, and social well-being of the community—one that will benefit current and future generations of Kaysville residents. |

|

|

|

Power and Water Rate IncreasesWhile general government services—such as police, fire and EMS, and parks and recreation—are funded through the City’s general fund, which is primarily supported by tax revenues (e.g., property tax), utilities such as power, water, and sewer operate from enterprise funds. These are separate from the general fund and are funded directly by the fees residents pay for those utility services. Effective July 1, 2025, utility rates increased to help cover the cost of providing and maintaining these services: - Water: up 15%

- Power: up 10%

- Storm Drain: up 20% Kaysville City’s eight water division employees maintain and operate more than: - 168 miles of drinking waterlines

- 7 water tanks

- 3,600 valves

- 1,700 fire hydrants

- 9,100 service line meters

- 6 chlorine monitoring stations

- 3 pump houses They also perform daily water sampling and monitoring and make approximately 250 waterline repairs each year to ensure Kaysville continues to have safe and reliable drinking water. As waterline breaks have become more frequent, it has become increasingly clear that capital investment must be increased to replace Kaysville's aging pipes. The chart below projects and compares revenues and expenses in Kaysville’s water fund over the next 10 years. - Expenses are shown in: - Light blue (operating expenses)

- Dark blue (cost of water purchased from Weber Basin)

- Green (capital improvements) - Revenues, which come from resident and developer fees, are shown as orange bars. As indicated in the chart, while FY2024–25 revenues were sufficient to cover water purchase (dark blue) and operating costs (light blue), they fall short in the revenues needed to keep up on capital improvements to replace aging infrastrastructure (green). Without a rate increase, even basic operating expenses are projected to surpass revenues in coming years. |

|

|

|

|

|

In 2024 alone, Kaysville’s water division made approximately 250 waterline repairs. Much of the city's water infrastructure system is made up of ductile iron pipe, a commonly used material that has been discovered to become susceptible to corrosion over time. The image below shows an example of corroded ductile iron pipe currently being replaced throughout the city. Kaysville has been actively replacing old ductile iron with corrosion-resistant plastic C900 pipe, and this work will remain a major priority for the city in the years ahead. |

|

|

|

Figure 7: Corroded ductile iron waterline |

|

|

|

Figure 8: Typical waterline repair in Kaysville |

|

|

|

As with water rates, electricity rates must also increase to keep pace with the actual cost of purchasing and delivering electricity to residents. The related chart below shows: - Orange bars: projected electricity revenues

- Light blue: operating expenses

- Dark blue: cost of purchasing electricity

- Green: capital improvement costs |

|

|

|

|

|

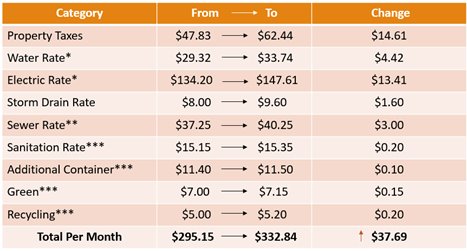

SummaryAs shown in the table below, the average Kaysville resident is expected to see a monthly increase of $14.61 in property tax (based on a home valued at $690,000), along with utility rate increases, for a total estimated monthly impact of over $37 per household. Actual property tax impacts will vary based on home value, while water and electricity rate increases of 15% and 10%, respectively, will affect households differently depending on usage. |

|

|

|

Figure 10: Impact of FY26 Cost Changes to Average Kaysville Resident

*Based on average Kaysville resident total monthly water and electric bill

**North Davis and Central Davis Sewer District rate increase

***Robinson Waste rate increase |

|

|

|

Kaysville’s mission is to “enhance the present and future quality of community life in Kaysville through the delivery of effective, efficient, and equitable services.” The FY26 budget supports this mission by continuing to maintain relatively low taxes and utility rates within the county, while also ensuring the City can provide the high-quality, efficient services residents expect and rely on. |

|

|

|

|

|